In today's digital age, where financial services are increasingly being offered through mobile applications, Navi Loan App has gained attention as an easy and convenient way to access quick loans. However, with the rise in online scams and fraudulent activities, it's essential to verify the authenticity of such applications before entrusting them with personal and financial information. In this article, we will delve into the details of Navi Loan App, analyze its legitimacy, and provide you with the necessary information to make an informed decision.

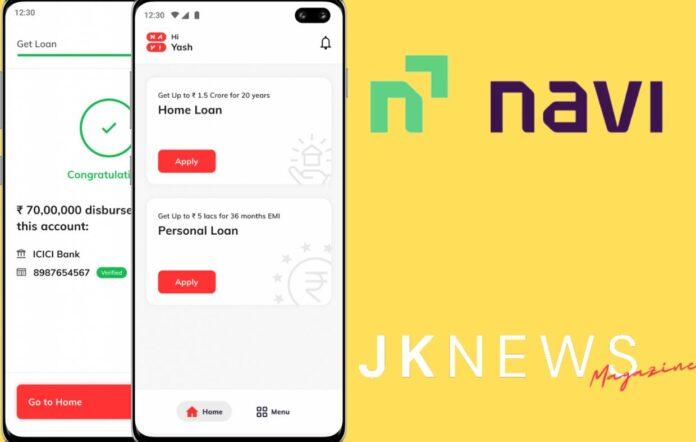

Navi Loan App is a mobile application that claims to offer hassle-free loans with minimal documentation requirements. It aims to provide individuals with quick access to funds during emergencies or financial crunches. The app promises a seamless user experience, competitive interest rates, and flexible repayment options, making it an attractive option for those in need of immediate funds.

Also Read :JK Tyre Share Price | Must Read Before Investing

Determining whether Navi Loan App is real or fake requires careful consideration of various factors. Let's explore some key aspects that can help assess its authenticity.

User Reviews and Ratings

One effective way to gauge the credibility of an app is by considering user reviews and ratings. Check out the feedback provided by existing users of Navi Loan App on reliable platforms such as app stores, forums, or social media groups. Authentic reviews can provide insights into the app's performance, customer service, and overall user experience.

App Store Verification

Authentic mobile applications are typically available for download on reputable app stores such as Google Play Store or Apple App Store. Before downloading Navi Loan App, verify its presence on these official platforms. App stores generally have stringent verification processes, reducing the risk of fake or malicious apps.

Company Background and Reputation

Research the background and reputation of the company behind Navi Loan App. Look for information regarding their incorporation, licenses, and any affiliations with established financial institutions or regulatory bodies. A reputable company will likely have a transparent track record and be associated with trustworthy partners.

Also, Read: Rajkotupdates. news:apple-iPhone-exports-from-India-doubled-between-April-and-August

To better understand Navi Loan App, let's explore the step-by-step process involved in using the app.

Registration and Verification Process

To begin using Navi Loan App, users need to download the application from the official app store and register using their personal information. The app may require users to provide identity and address proof for verificationpurposes. Once the registration is complete, the user's profile will be created within the app.

Loan Application Process

After successful registration, users can proceed with the loan application process. They will need to provide relevant details such as loan amount, purpose, and repayment tenure. Navi Loan App may also require additional information regarding employment, income, and banking details to assess the user's eligibility for a loan.

Loan Approval and Disbursement

Once the loan application is submitted, Navi Loan App will evaluate the provided information and determine the loan eligibility. If approved, the loan amount will be disbursed directly into the user's designated bank account. The app may have specific criteria and algorithms in place to calculate the loan amount and interest rates based on the user's profile.

Navi Loan App offers several features and benefits to its users, making it an attractive option for those seeking quick loans. Here are some notable advantages:

Quick and Easy Loan Application

Navi Loan App simplifies the loan application process by digitizing the documentation and verification procedures. Users can apply for a loan conveniently from the comfort of their homes, eliminating the need for extensive paperwork and physical visits to the lender.

Flexible Repayment Options

The app provides users with flexible repayment options, allowing them to choose a repayment tenure that suits their financial situation. This flexibility ensures that borrowers can comfortably repay the loan without straining their monthly budget.

Competitive Interest Rates

Navi Loan App aims to offer competitive interest rates to its borrowers. By leveraging technology and automation, the app streamlines the lending process, potentially reducing overhead costs and enabling them to offer loans at more favorable interest rates.

Transparent Terms and Conditions

Transparency in terms and conditions is crucial when dealing with financial applications. Navi Loan App strives to maintain transparency by clearly communicating the loan terms, interest rates, processing fees, and any other charges associated with the loan. This helps borrowers make informed decisions and avoid any hidden surprises.

While Navi Loan App may provide several benefits, it's important to be aware of potential risks and concerns. Consider the following factors:

Privacy and Data Security

When using any financial application, including Navi Loan App, it's crucial to prioritize data privacy and security. Ensure that the app has robust security measures in place, such as encryption and secure data storage, to protect your personal and financial information from unauthorized access.

Hidden Fees and Charges

Carefully review the terms and conditions of the loan offered by Navi App to understand the complete cost structure. Be cautious of any hidden fees or charges that may increase the overall repayment burden. If something appears unclear, seek clarification from the app's customer support before proceeding.

Customer Support and Complaints

Consider the availability and quality of customer support provided by Navi App. Check if they have a responsive customer support team that can address your queries and concerns promptly. Research online for any complaints or negative feedback from users regarding the app's customer service or dispute resolution process.

To verify the authenticity of Navi App or any similar financial application, consider the following tips:

- Research the Company: Conduct thorough research on the company behind the app. Check their website, look for information about their management team, partnerships, and regulatory compliance.

- Check Official Website and Social Media Presence: Visit the official website of Navi App to gather more information about the app's features, terms, and conditions. Additionally, check if the company has an active presence on social media platforms, as legitimate companies often engage with their users through these channels.

- Seek Feedback from Existing Users: Reach out to existing users of Navi Loan App or join online communities and forums related to personal finance. Engage with users who have experience with the app and inquire about their satisfaction levels, any issues they encountered, and overall reliability.

Conclusion

In conclusion, Navi Loan App offers an easy and convenient way to access quick loans. While the app has several attractive features, it is essential to conduct due diligence and verify its authenticity before providing personal and financial information. Consider factors such as user reviews, app store verification, and the company's background and reputation. By following the tips provided in this article, you can make an informed decision and mitigate the risks associated with online financial applications.

FAQs

- Is Navi Loan App safe to use? Navi Loan App's safety depends on various factors such as its security measures, user reviews, and adherence to regulatory guidelines. Before using the app, ensure that it employs robust security protocols and has positive feedback from reliable sources.

- How long does it take to get a loan approval from Navi Loan App? The time taken for loan approval may vary based on several factors, including the completeness of the application and the app's internal processes. Navi Loan App aims to provide quick approvals, and in many cases, users receive loan disbursements within a few hours or days.

- What are the eligibility criteria for Navi Loan App? Navi Loan App typically has eligibility criteria related to age, income, employment status, and creditworthiness. The specific requirements may vary, and it's advisable to refer to the app's guidelines or contact their customer support for detailed information.

- Can I repay the loan early without any penalties? Navi Loan App's policy regarding early repayment without penalties may vary. Review the terms and conditions provided by the app to understand their stance on early loan repayment. It's recommended to clarify this aspect before availing a loan.

- What happens if I default on the loan repayment? Defaulting on loan repayment can have serious consequences, potentially impacting your credit score and attracting penalties, additional fees, or legal action. It is crucial to honor your repayment obligations and communicate with Navi Loan App in case of any financial difficulties to explore alternative solutions.