Money borrowing apps, also known as peer-to-peer (P2P) lending platforms, have become increasingly popular in recent years. These apps connect individual borrowers with investors who are willing to lend money, allowing borrowers to access loans without going through a traditional bank.

The use of these apps offers a number of benefits, including faster loan processing times and potentially lower interest rates.

However, there are also some potential drawbacks to consider. In this article, we will explore the benefits and drawbacks of using money borrowing apps.

Benefits

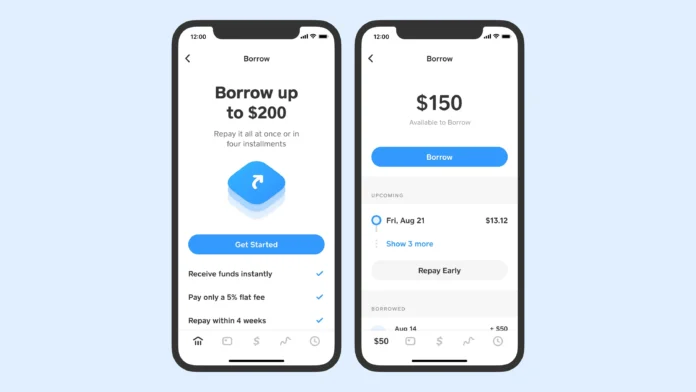

- One of the key benefits of using a money borrowing app is that the process is typically much faster and more convenient than applying for a loan through a bank. Many of these apps allow users to apply for a loan and receive approval within minutes, and the funds can be deposited into their account within a day or two.

- Another benefit is that the interest rates on loans from money borrowing apps are often lower than those offered by banks. This is because the investors who lend money through these platforms are typically willing to take on a higher level of risk in exchange for a higher return on their investment.

Drawbacks

- However, there are also some potential drawbacks to using a money borrowing app. For one, these platforms may not be suitable for borrowers with poor credit, as the investors who lend money through these apps are typically more risk-averse than banks and may be less willing to lend to borrowers with a history of defaulting on loans.

- Additionally, the fees associated with borrowing money through a money borrowing app can be higher than those charged by a bank, so it's important to carefully compare the costs before deciding which option is best for you.

- Despite these potential drawbacks, money borrowing apps can be a valuable resource for individuals who need access to quick, convenient loans. Whether you're looking to pay off a credit card balance, make a large purchase, or cover an unexpected expense, these apps can provide you with the funds you need, often at a lower cost than you would pay at a traditional bank.

Examples Of Money Borrowing Apps

Some examples of money borrowing apps include

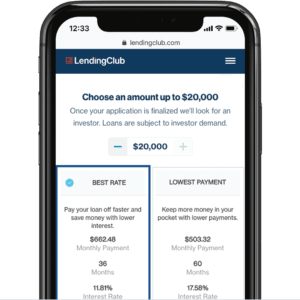

- LendingClub

- Prosper, and

- Upstart.

Money Borrowing Apps In US

In the United States, These have become increasingly popular in recent years. These apps connect individual borrowers with investors who are willing to lend money, allowing borrowers to access loans without going through a traditional bank. This can be a convenient and cost-effective option for individuals who need access to quick, convenient loans.

Some examples of popular money borrowing apps in the United States include LendingClub, Prosper, and Upstart. However, it is important to carefully compare the fees and terms of these apps before deciding which one is the best option for your needs.

Conclusion

In conclusion, money borrowing apps can be a valuable resource for individuals who need access to quick, convenient loans. These apps connect borrowers with investors who are willing to lend money, allowing borrowers to access loans without going through a traditional bank. The use of these apps offers a number of benefits, including faster loan processing times and potentially lower interest rates.

However, there are also some potential drawbacks to consider, such as the potential for higher fees and the difficulty of obtaining a loan for individuals with poor credit.

Overall, it is important to carefully compare the fees and terms of different money borrowing apps before deciding which one is the best option for your needs.